Below is an explanation of how to write off a fixed asset (ie.plant and equipment).

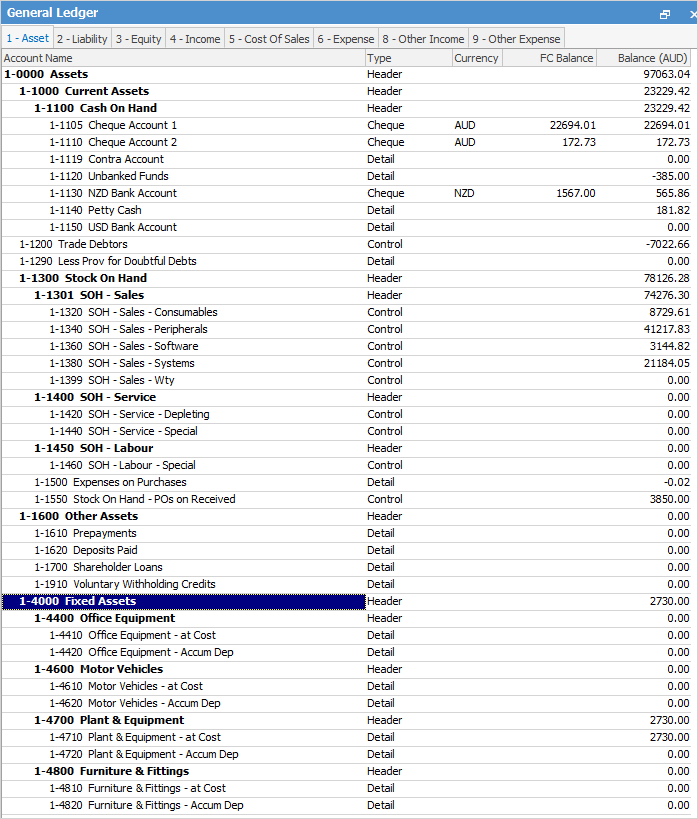

Typically, the general ledger fixed assets are grouped together into categories such as Office Equipment, Motor Vehicles, etc. The general ledger will show the value of this equipment.

Most businesses keep the detail of what equipment makes up this value with their external accountant or on a spreadsheet.

Most fixed assets accounts have an associated accumulated depreciation account which tracks the value written down.

First, find out the full value of the plant and equipment, as well as the associated depreciation. For example a forklift cost $2,730 in 2014, and for the past 5 years was been depreciated $46 a year, so accumulated depreciation is also $230.

In this example, create a general journal as follows

▪Debit Accum Depr $230

▪Credit Fixed Asset $230.

If the depreciation is less than the value, a third account will be needed. Using example above $2,500 in 2016, depreciated at $500 per year for two years so accumulated depreciation is $1,000.

So, the journal for this example would be

▪Debit Accum Depr $1,000

▪Debit Equipment Exp $1,500

▪Credit Fixed Asset $2,500.

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments