Tax codes in Jim2 are used to calculate GST and related taxes, and to calculate the relevant values required for a GST session. Tax codes are included in sections throughout Jim2, however the focus here is on the use of tax codes in general ledger accounts, cheque book entries, general journals, expense orders and debtor/creditor adjustments.

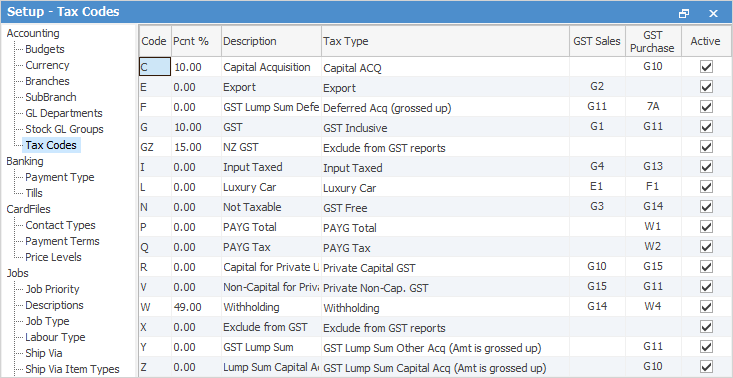

In Tools > Setups > Accounting > Tax Codes, Jim2 displays the tax codes, as well as where and how they report in GST sessions:

It may be advisable to review these with the company's accountant for further clarification.

|

Tax codes should not be added to this master list without first consulting Happen Business. |

It is important to ensure the correct tax code is used in each line of a transaction, prior to finishing the transaction.

Tax Code X is used on any accounts and/or transactions where there is no GST and BAS reporting, such as: ▪asset accounts, ie. bank accounts, prepayments, depreciation on fixed assets ▪liability accounts, ie. credit card accounts, liability accounts, ie. the GST collected and paid, superannuation payable, loan accounts and accruals ▪equity accounts, ie. capital, drawings, and retained earnings ▪income/other income/COGS/expenses/other expense accounts, ie. interest received or paid, stamp duty, import duty and stock adjustments ▪all payments to the ATO ▪general journals if moving balances between general ledger accounts, including accountants end of financial year adjustments. ▪debtors/creditors adjustments, if moving balances between accounts ▪the bank account side of all cheque book transactions – withdrawal or deposit – this is automated by Jim2.

Tax Code N is used on accounts and/or transactions where there is no GST and there is BAS reporting such as: ▪some expense accounts, ie. bank fees that do not incur GST (however, some charges do incur GST, so it is best to check with the bank) ▪Some staff amenities, ie. tea, coffee, milk, sugar, bottled water ▪invoices from suppliers who have an ABN and are not registered for GST.

Tax Code E is a sales only GST designation for export revenue only.

Tax Code F is used for deferred lump sum GST.

Tax Code G is used on all transactions which incur GST.

Tax Code C is used on the purchase of fixed assets (capital acquisitions).

Tax Code P is used for gross wages on payroll general journals so the figures report into the correct area in GST Sessions.

Tax Code Q is used for PAYG withheld from wages on payroll general journals so the figures report into W2 in GST sessions, but should never be used when paying the ATO – or the amount will be deducted from W2.

Tax Code Y is used on bulk GST payments to a customs agents on imports. |

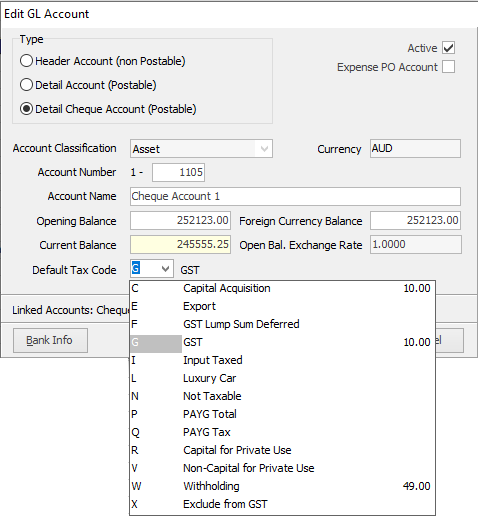

Default tax codes can be set against individual general ledger accounts. This means, whenever a transaction is recorded against a general ledger account, the tax code is automatically selected based on that default.

To set a default tax code for a general ledger account: ▪on the ribbon, go to Accounts > General Ledger, and locate the required account ▪double click on the general ledger account to open in Edit mode ▪click the down arrow in the Default Tax Code field, select the required tax code and click OK.

|

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments