Creditors adjustments up and down assist in moving (or transferring) from one creditor to another.

Creditor adjustments should only be done to resolve discrepancy of petty monetary values with creditors only. Do not use creditor adjustments if there is any stock involved. You are only moving money values – not adjusting stock on hand levels. Therefore, you can use a creditors adjustment to simply move a payment from one supplier to another, even if the PO has been finished, as no stock will be affected.

Creditor adjustments can also be used for foreign currency gains or losses.

If you want the balance outstanding to increase, use a creditors adjustment up. If you want the balance outstanding to decrease, use a creditors adjustment down. Reducing will create a credit that can then be applied to reduce a current balance. Increasing will effectively create an amount that needs to be paid.

Creditor adjustments, whether they are up or down, do not represent COGS of stock value, and need to be allocated to an expense or income account in your general ledger. Jim2 will prompt you to allocate the adjustment to a GL account and create a journal for you to balance the transaction.

You can add amounts to your creditor's record without having to purchase from the vendor. This is useful when you need to add bank fees for a dishonoured cheque, etc.

|

This is the best way to handle a payment that has bounced back due to entering an incorrect bank account. The creditors adjustment up will put the value back into the creditor's account, and post it back to the bank account. This will debit the bank account for the reversal, and use tax code X. Once the type of creditors adjustment has been selected, the cursor will be placed at the GL Account field for you to select the required general ledger account. Enter the amount into the Amount field – if this transaction includes tax you will need to enter the amount as Tax Inclusive and then select the appropriate tax code. A comment is required when entering creditors adjustments. |

|

To reverse (or cancel) a creditors adjustment, simply add a further adjustment opposite to the first one, ie. if you did an adjustment up, do an adjustment down. |

1.Open the Creditors List.

2.Locate and open the creditor. Click Edit.

3.Select the type of creditors adjustment up or down.

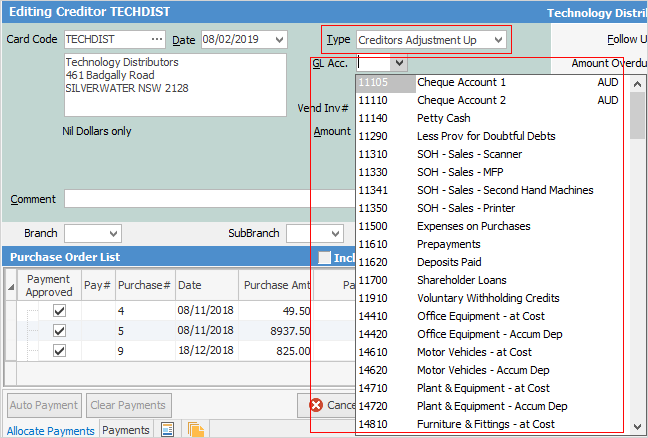

4.Use the drop-down list to select the general ledger account that you want to be affected by this entry.

|

Do not use the Trade Creditors Control Account. This GL account selection is for the other side of the creditors transaction, for example, the expense account. Creditors will offset the account selected here. |

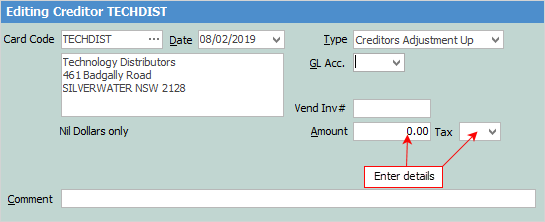

5.Enter a vendors invoice number for your reference.

|

The Vend# appears only on creditor adjustments up, not down. You can use the Comment field in the creditor adjustment down to record this information. |

6.Enter the amount of the adjustment and select a relevant tax code.

|

You will see some letters underlined in the field names within the header, eg. Date. Using Alt+ the underlined letter will jump you to the field beside that heading. |

|

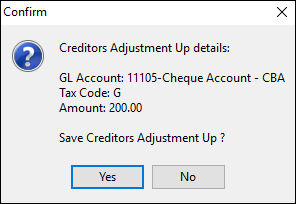

This adjustment will then increase the creditor's balance, increase the selected GL account, and increase the Tax account – this adjustment can be paid the same way as a purchase. |

7.You must to enter a comment before saving a creditors adjustment up or down.

8.Click Save.

9.The adjustment up entry will now be created.

Further information: