It is important that your Jim2 Purchase Orders and Expense Orders are entered correctly. This includes linking expenses to specific purchase orders to ensure correct Cost of Goods is calculated for imported stock.

Purchases from overseas suppliers may require a bulk GST payment. This GST payment, along with other associated costs, is usually made to a Customs Agent. In these circumstances, there are two Jim2 orders raised:

▪Jim2 Purchase Order for the stock,

▪Jim2 Expense Order for the Bulk GST and other import charges.

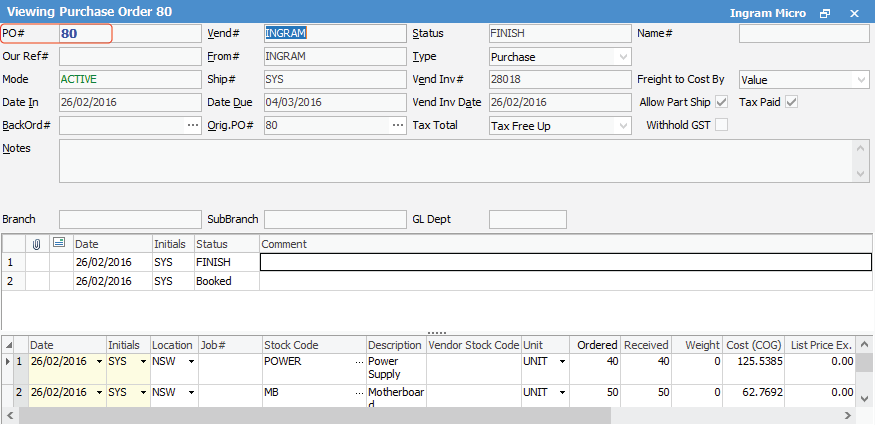

Jim2 Purchase Order

The purchase order is raised against your overseas supplier to record the cost of the stock provided. This purchase order is only used for charges payable to your overseas supplier.

Where the purchase is subject to a bulk GST payment, the tax code used for each line of stock in the purchase order is tax code X.

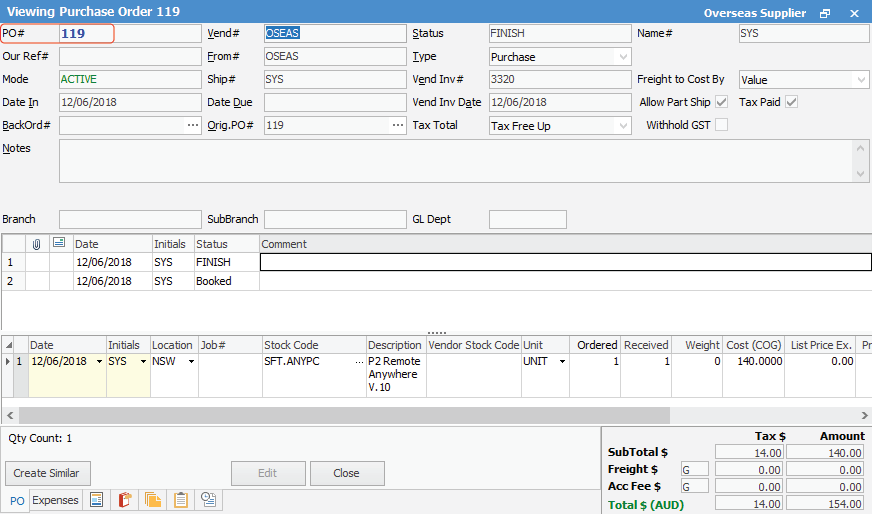

There are circumstances where purchases from overseas suppliers may not be subject to GST. This is usually the case where the purchase has not needed to pass through a Customs Agent. Where the purchase is not subject to GST, the tax code used for each line of stock in the purchase order is tax code N.

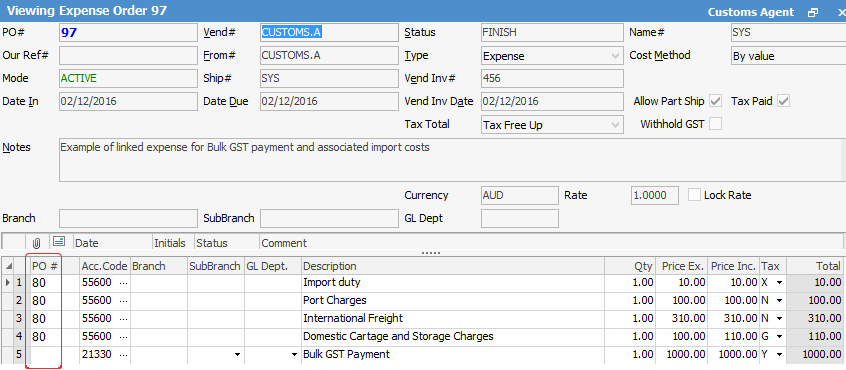

Jim2 Expense Order

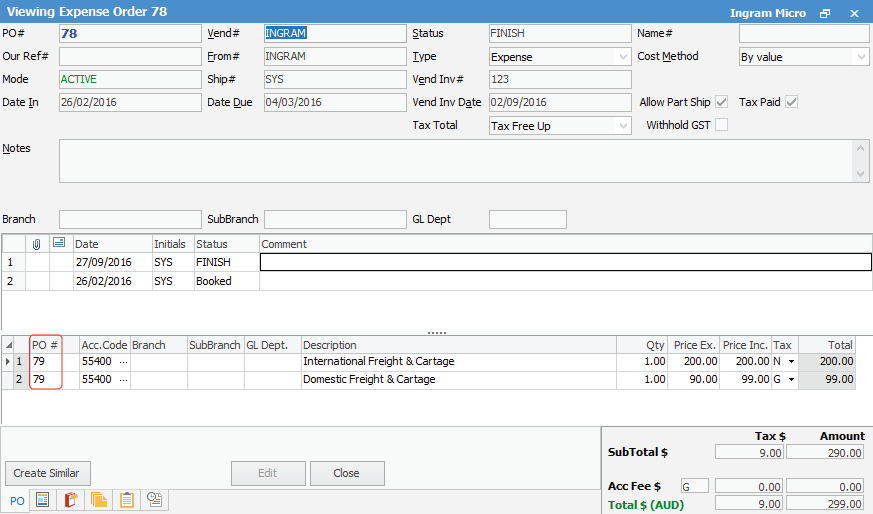

Linked to the purchase order will be an expense order. This EXPENSE ORDER will include lines for associated import costs. Each line of associated import costs is then linked to the purchase order for the stock.

An expense order may also have a line to record the bulk GST payment.

|

Bulk GST on an expense order cannot be linked to a purchase order. |

Jim2 Tax Codes and how they apply to Overseas Purchases

Charge or Expense |

Tax Code |

|---|---|

Overseas supplier invoices for stock |

X |

Import Duty |

X |

Port Charges without GST |

N |

Tradegate Charges with GST |

G |

International Freight Charges |

N |

Domestic Cartage & Storage Charges |

G |

Bulk GST on Stock imports |

Y |

Bulk GST on Capital Acquisitions (equipment) |

Z |

Australian Government Charges |

If you report this expense to the ATO in your BAS, tax code is N. If you do not report this expense, tax code is X |

For further information on Tax Codes, see here.

Example of a purchase order raised for an overseas supplier where the goods have passed through a customs agent.

Example of an expense order raised for associated import costs and bulk GST. Note the link to purchase order 80, except for the line relating to the bulk GST.

Example of purchase order raised for an overseas supplier where there is no requirement for a GST payment.

Example of a linked expense order raised for related freight costs (linking lines on expense order 78 to stock codes on purchase order 79). Note the use of '79' in the PO# field on the expense order.

Further information: