There are two tax free codes available, and the one selected as the default should reflect what the company uses most frequently for overseas transactions.

For example:

▪If the majority of overseas jobs are exports, tax code E should be selected. Tax code E is used for export revenue only, and transactions using this code will report at G2 on the BAS Calculation Worksheet.

▪If export transactions are not the majority, then tax code X is more appropriate. Tax code X is used for tax free transactions that are not exports.

The selected tax code will default when creating a job for a tax-free customer, although this can be overridden by the user at the time of job creation.

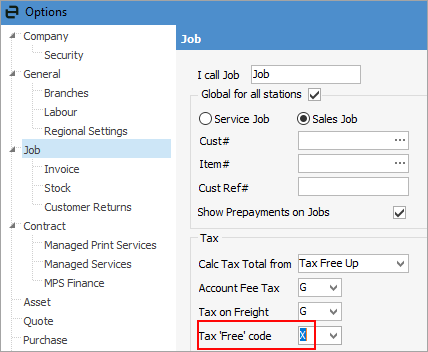

On the ribbon, go to Tools > Options > Jobs and set the tax code to E or X, according to the above.

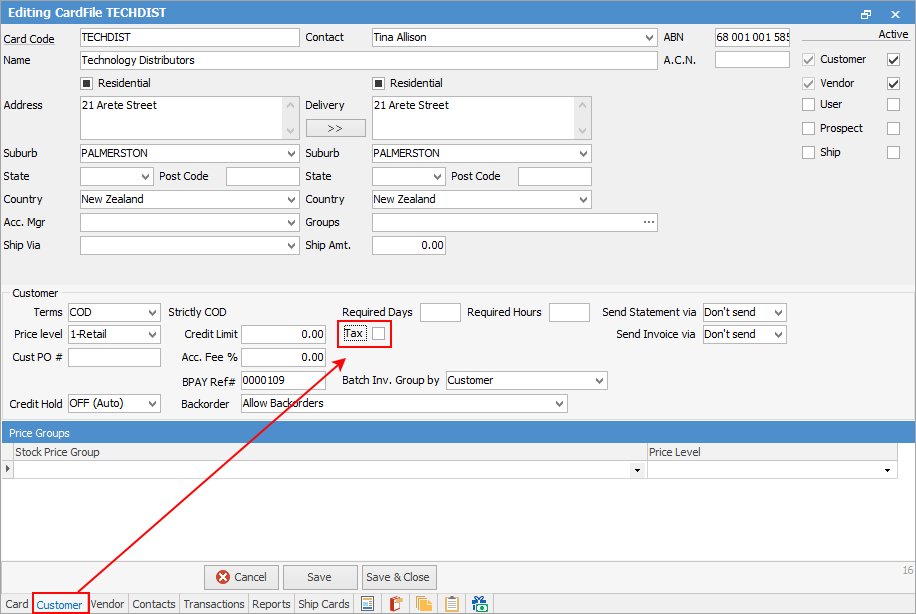

If using tax code X, on the Customer cardfile go to the Customer tab and untick the Tax tick box. This tells the system that the customer does not pay tax.

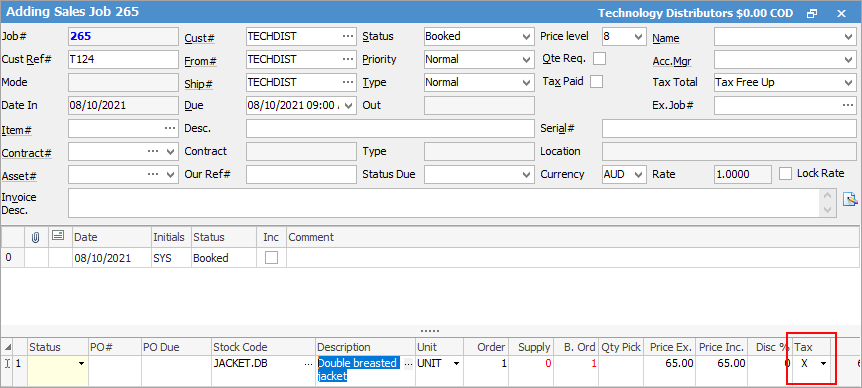

When creating a job for the relevant customer, and add stock the tax code will default to E if set up via Options above, or X, if set on the customer cardfile.

Further information

Bulk Update CardFiles with BPAY Ref

Export a CardFile Report to Spreadsheet