If your company receives a gift card, you can use it to pay for purchases/expenses.

The following outlines the steps involved and will use a $2500 gift card as an example.

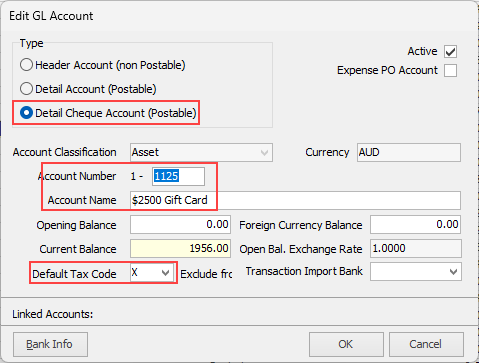

Create a new Detail Cheque Account (Postable) Asset account for the $2500 gift card using default tax code X.

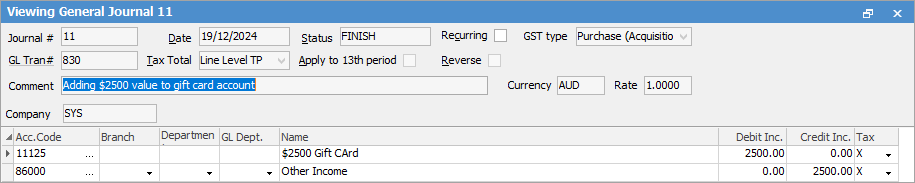

Enter a general journal to add the $2500 value to the Gift Card account, ensuring tax code is X.

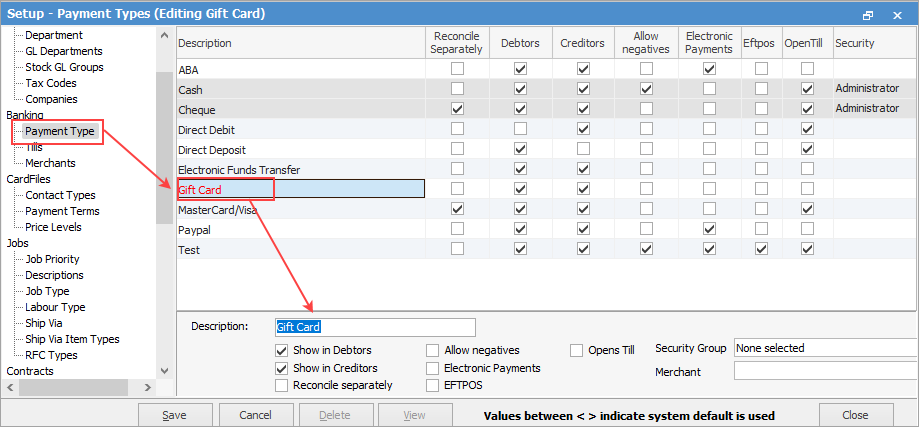

Create a Payment Type called Gift Card.

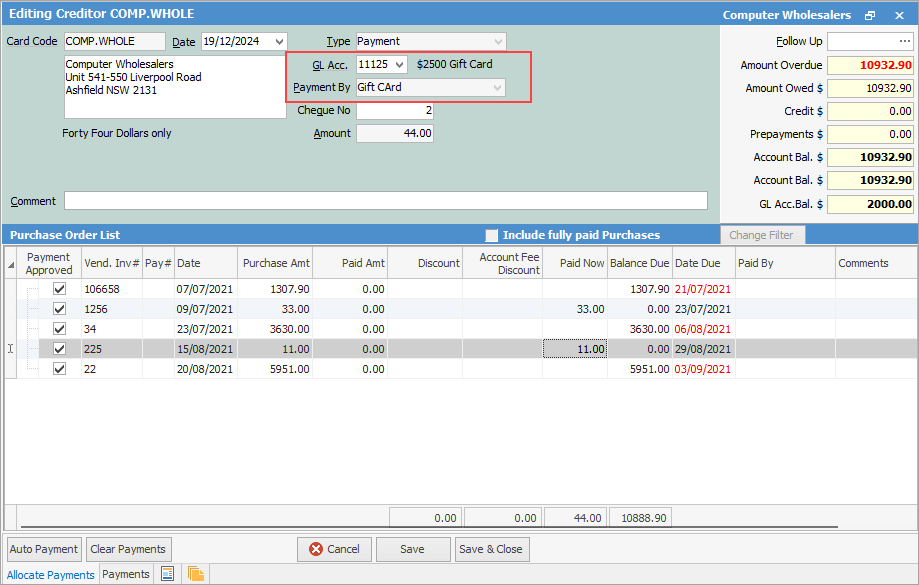

Enter your purchase/expense orders as normal.

When entering payment for the relevant supplier invoices, choose the Gift Card account set up above, and select Payment By Gift Card.

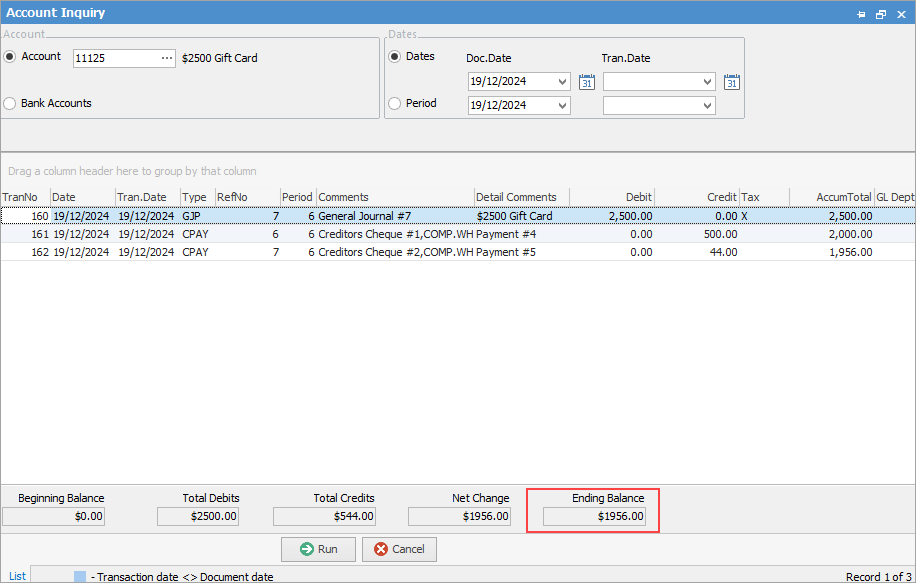

You can perform an account inquiry for the Gift Card account to see how much is remaining on the gift card.

|

Note: You can also add chequebook entries to record expenses if you don't wish to use expense orders. |

Further information

Factor a Procedure with 3rd Party Debtor Finance

Give a Customer a Permanent Discount

Pay Commission to a Contractor

Record Commission Payment from Vendor