|

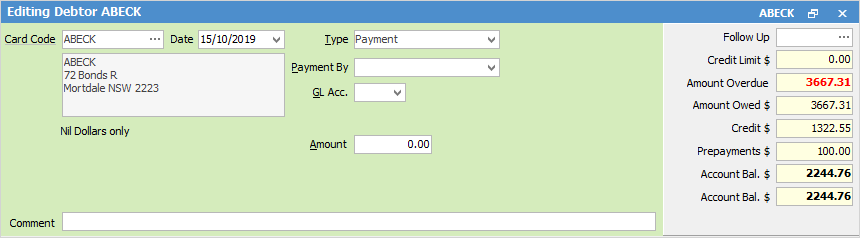

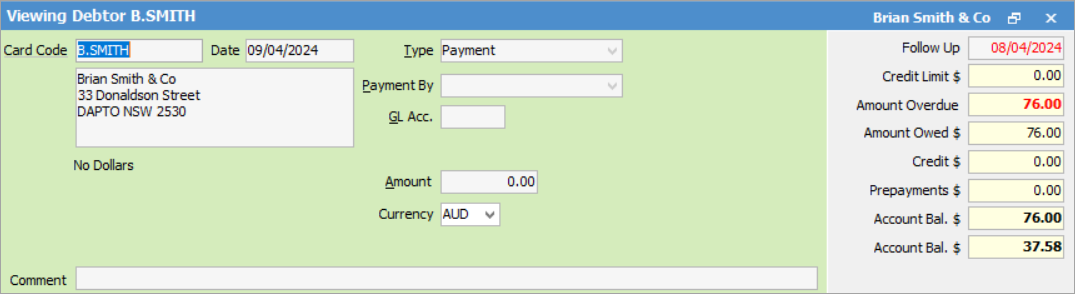

The debtor form contains several areas which display a customer's information and transactions, including a column showing which banking session the banked payment relates to (from the Payments tab in the footer).

The top green section of the debtor form displays the customer's information, and is used to record a transaction.

Some fields provide hyperlink access to view associated information. Hovering the cursor over the wording to the left of the field will display the label name in blue if it is hyperlinked. Click on the label and choose the option to view. Card Code – will open the cardfile of the code entered here.

|

|

|

Card Code

|

The customer's card code. The customer's name and address will be displayed under the Card Code field. Hover over Card Code and it will become a hyperlink which will open the cardfile of the entry here.

|

Date

|

The date of the entry. The default is today's date (displayed in black text). This date can be changed, in which case it will be displayed in red text.

|

|

Note: Once a different date has been entered for the day, the same date will appear each time when entering further transactions, however this can be changed.

|

|

Type

|

The type of entry – payment, prepayment, refund, bad debt, discount, account fee, debtors adjustment up or down and creditors contra.

|

|

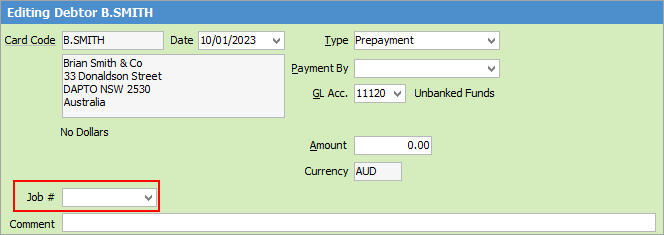

Note: When entering a prepayment, a Job field will appear so you can choose the job to allocate the prepayment to:

|

|

Payment By

|

Payment type – cash, cheque, etc. This field is only displayed when the transaction type is Payment, Prepayment or Refund.

|

|

Note: Once a Payment By type has been selected for the day, the same type will appear each time when entering further transactions, however this can be changed.

|

|

GL Acc.

|

Select the general ledger bank account for this transaction.

|

Cheque No

|

This field is only displayed/used when the transaction type is Refund. It shows the next available cheque number, depending on the general ledger bank account.

|

Amount

|

The amount of the transaction.

|

Tax

|

This field only appears when entering a debtors adjustment up or down. Use the drop down list to select the appropriate tax code.

|

Comment

|

Enter a comment for the transaction. Note that some transactions (ie. debtor/creditor adjustments) require entry of a comment.

|

|

Note: Entries in this field will appear in the Comment section of the payments grid.

|

|

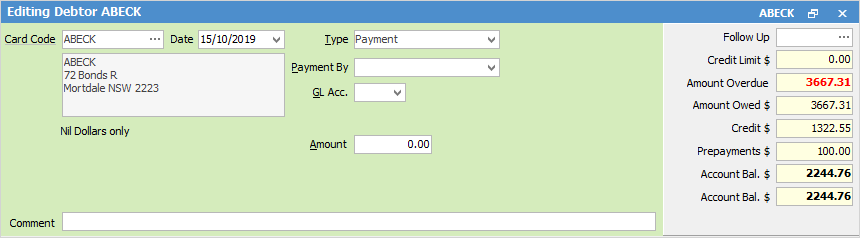

The top, right-hand side of the form is the Balances section.

|

|

|

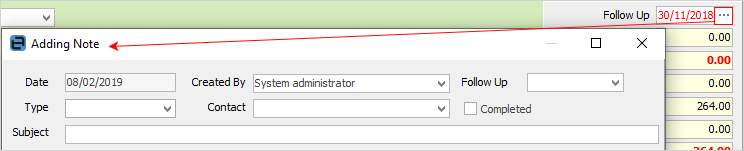

Follow Up

|

This field is normally blank, however if a note or comment was recorded for this customer it will appear here in black text. If that was not followed up by its due date, the date shown will be coloured red. Click the ellipsis [...] on the right of the field to add a note.

|

Credit Limit $

|

The credit limit for this customer as set up in their cardfile.

|

Amount Overdue

|

The total of any invoices which were not paid within the period set by terms in the customer's cardfile.

|

Amount Owed $

|

The total amount owing on this customer's account, current and overdue, before any credits.

|

Credit $

|

The balance of any credit entries that are not yet applied to an invoice

|

Prepayments $

|

The balance of any prepayments that are not yet applied to an invoice.

|

Account Bal. $

|

The total balance outstanding for the customer's account, including any credits or prepayments not applied to invoices.

|

Account Bal. $

|

The total balance outstanding for the customer's account, including any credits or prepayments not applied to invoices. This field is always displayed in the home currency.

|

GL Acc Bal

|

The general ledger account balance when entering refunds or debtors adjustments up or down. This field is not usually shown for other transaction types.

|

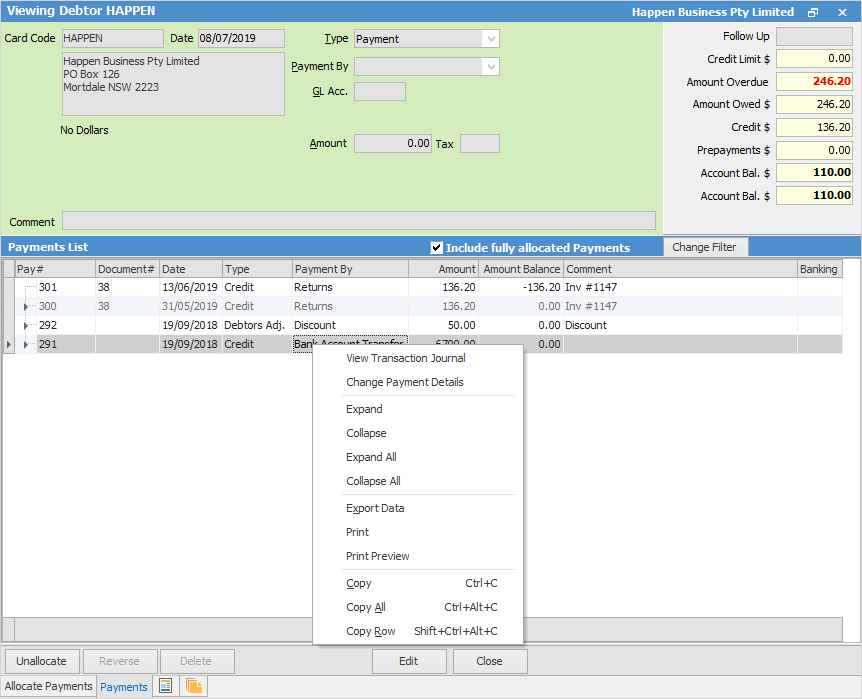

From within the debtor form, right click options by line:

|

|

Date field in Follow Up is coloured red to indicate that the follow up date has passed.

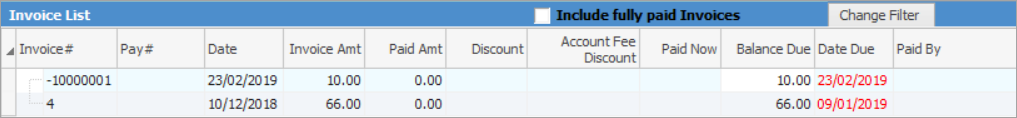

Amount Overdue will be coloured red when an amount is owing.

Date Due coloured red indicates that the due date has already passed.

|

|

|

View Transactional Journal

|

View the the Transaction Journal for the selected line.

|

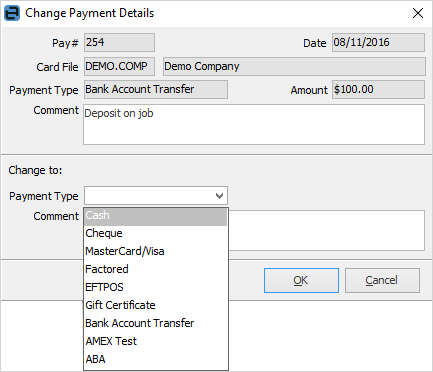

Change Payment Details

|

Provided the payment has not been banked or reconciled, the payment type can be changed here.

|

|

Note: You cannot change payment details on refund transactions. If you need to change details for a refund, it is best to cancel the refund in the cheque book and reprocess with the correct details.

|

|

Expand

|

Expand the line to see all entries

|

Collapse

|

Collapse entries to show only the line.

|

Expand All

|

Expand all lines.

|

Collapse All

|

Collapse all lines.

|

Export Data

|

Exports data from the grid to a spreadsheet file.

|

Print

|

Print the list.

|

Print Preview

|

Preview the list to be printed.

|

Copy

|

Copy the cell selected.

|

Copy Row

|

Copy the row selected.

|

Copy All

|

Copy all, which can then be pasted into a spreadsheet

|

|

Further information

Debtors Adjustments

Debtors Allocate Payments Grid

Debtors Auto Credit Hold

Debtors List

Debtors Documents Tab

Debtors Notes Tab

Debtors Opening Balances

Debtors Payments Tab

Debtors Statement Printing

Debtor Management

Debtors Reports

Apply a Credit/Prepayment

Clear a Credit on a Debtor

Clear Small Debtor Balances

Create a Debtor Refund

Enter a Credit

Enter a Credit Payment

Enter a Payment

Enter a Prepayment

Enter Discounts and Account Fees

Issue a Credit Note

Debtor Payments Including Commission

Move Unknown Payments to Debtor

Reversal Entries

Reverse Discounts and Account Fees

Reverse or Delete a Payment

Send Payment Receipts

Unallocate a Payment

Undo Incorrect Refund

|