Good management of debtors will assist in being paid faster, and prevent bad debts. Prompt collection of debtors’ accounts will also help maintain a healthy cash flow.

Managing debtors is often referred to as credit management, and includes:

▪setting payment terms

▪setting credit limits

▪collecting debts on time

▪regularly reviewing the debtors ledger

▪keeping accurate and up to date records.

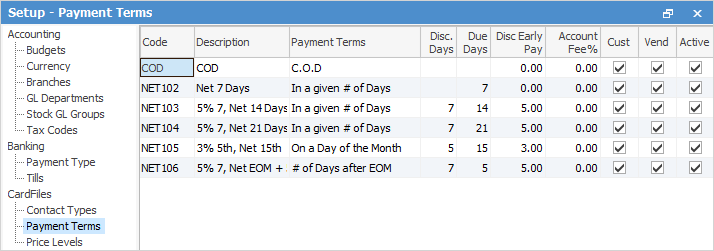

Ensure that the payment Terms set up in the Jim2 database reflect the actual trading terms of the business, and are set up correctly. For example if the terms are From Invoice Date, ensure that the setup reflects this, and that customers have the correct payment terms selected on their cardfiles.

On the ribbon, go to Tools > Setups > Payment Terms to check what has been set up. Add new terms if necessary.

|

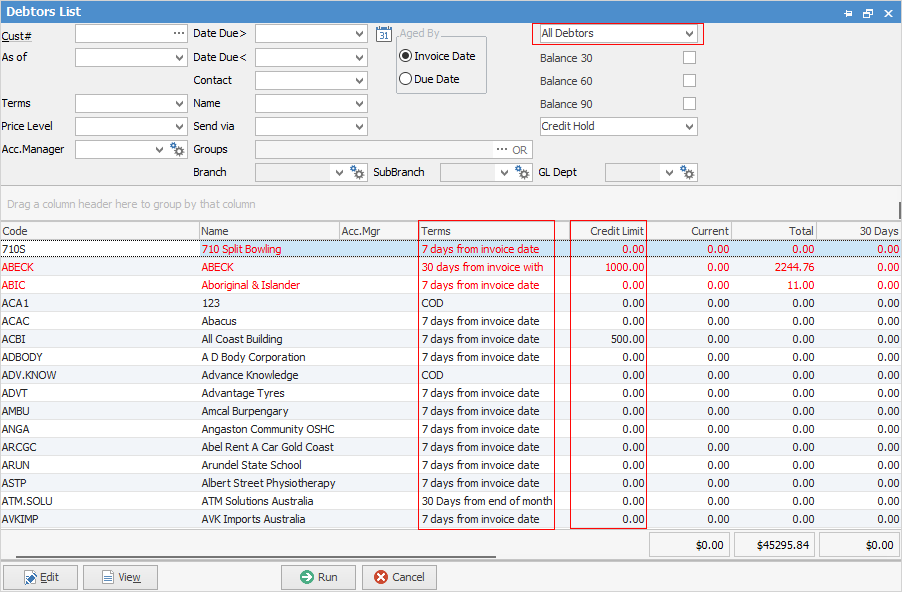

Once the required payment terms and customer records have been set up correctly, on the ribbon, go to Accounts > Debtors, select All Debtors and click Run.

The resulting list will include all customer records, regardless of whether they currently have a balance on their account or not.

Working from the Debtors list, review the customer terms set for each customer and ensure that they are correct.

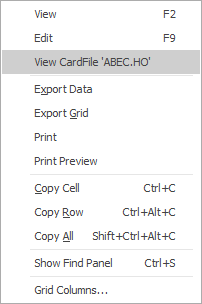

Right click on a record in the Debtors list, view and edit the cardfile to make any changes required.

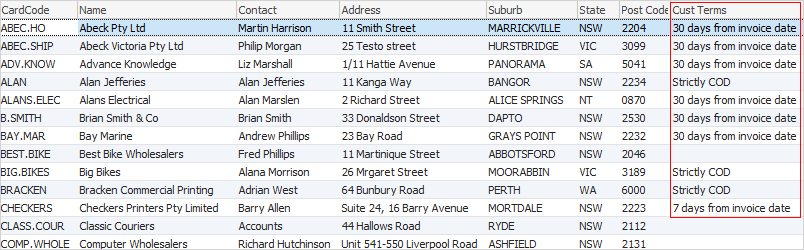

Customer terms can also be checked via a CardFile List. On the ribbon, go to CardFiles > Create CardFile List.

Check the customer terms in the list to ensure they are set correctly. They can be changed via the Customer tab on the cardfile. Check the Contacts tab on the cardfile to ensure that a contact phone number is entered, so that it prints on the Aged Receivables reports. Add an Email Accounts contact type and email address for the accounts contact person. |

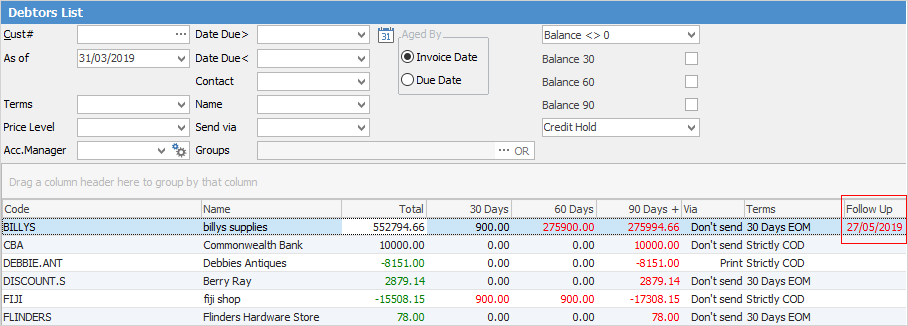

Use debtors Notes to add comments and set follow up dates for debt collection. The follow-up dates show in the Debtors list, and will turn red when the date is reached as a reminder to follow up now.

Set up Note types via Tools > Setups > Other > Notes > Add.

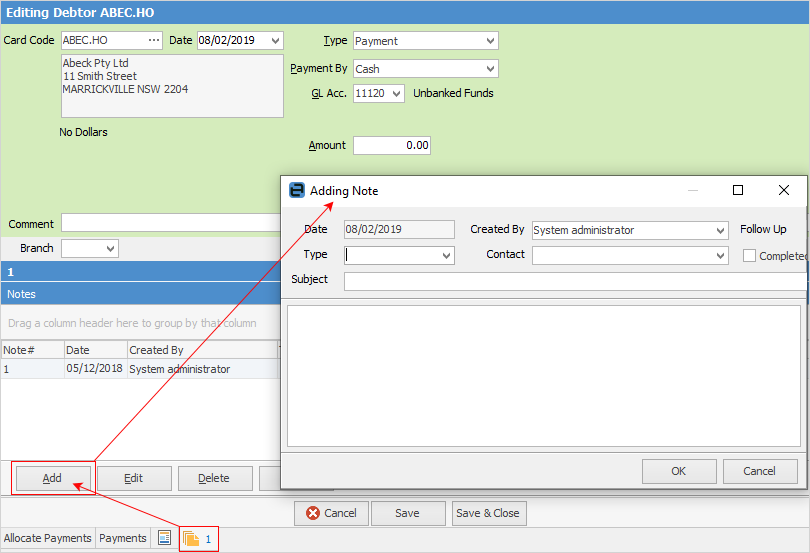

To add a Debtors Note, edit the debtors record, go to the Notes tab at the bottom and click Add.

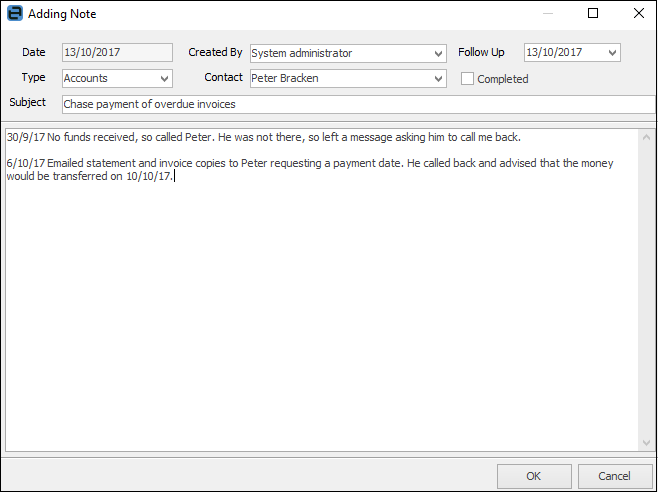

Select a Type, a contact person (one that is set up on the Contacts tab of the cardfile) and add a subject. Enter the information into the body of the note, and set a follow-up date.

Keep a record of all conversations and correspondence relating to a specific debt collection issue within one note by selecting the note and editing it, so the entire history is in one note. The Follow Up date can be changed as required until the issue is resolved.

Mark the note as Completed. If not marked as completed, it will stay in both the debtor form header and the Debtors list.

It is important to keep debtor records up to date so the information within them is accurate before chasing people for payment. All payments received should be entered promptly, and credits applied to invoices when applicable. |

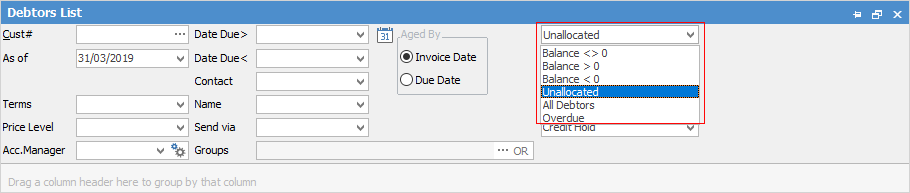

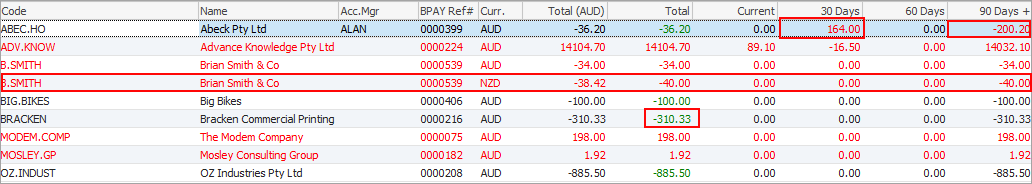

Filter a Debtors list to identify accounts with unallocated credits, so they can be verified and applied to invoices. From the selection at the top right of the Debtors list (Balance <>0 field) click Unallocated and Run.

The resulting list will only contain debtor records with unapplied credits on the account. Any green text in the Total column indicates that there are unapplied credits on the account.

If there is a credit balance, credits cannot be applied until there are invoices to apply to.

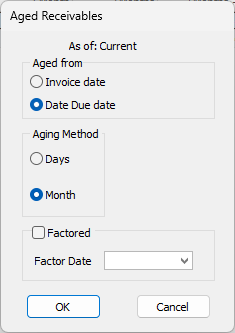

Filter the Debtors list by Due Date and click Run. The resulting list will include only invoices that are due for payment up to the date that has been set. Print the Detailed Aged Receivables report to reflect the information in the list for chasing payments.

|

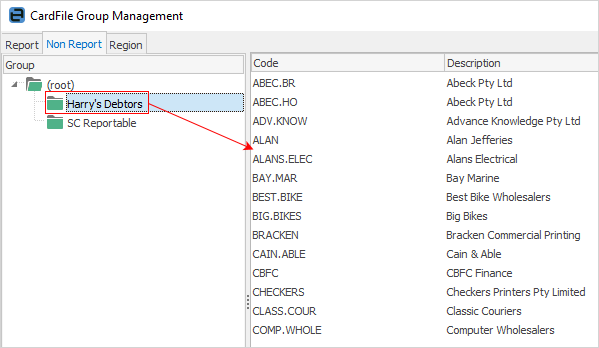

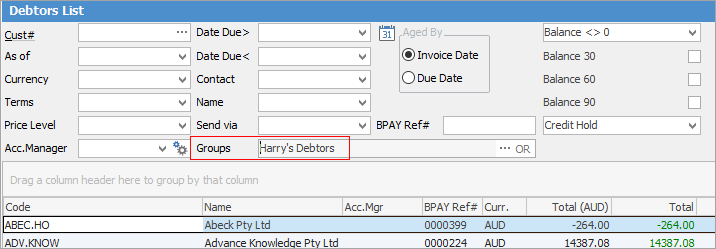

There may be more than one person responsible for debt collection, and each person may be responsible for a specific group of customers. Use cardfile Groups > Non Report Level to assign the debtors to the person responsible for their account.

Each person can run their Debtors list and reports based on only the customers they are responsible for.

|

Further information

Debtors Allocate Payments Grid

Enter Discounts and Account Fees

Debtor Payments Including Commission

Move Unknown Payments to Debtor