The Stock On Hand and Cost of Goods Sold functions in Jim2 are extremely flexible and reliable, to maintain an accurate Stock Control system.

As there are different Types of Stock in Jim2 we do not treat all stock in the same way when Purchasing and Selling.

As Labour and Applies types of Stock cannot be Purchased, they do not have any bearing on the Stock on Hand or the Cost of Goods Sold. Depleting, Special and Non Depleting can be purchased and therefore do create General Ledger entries.

Depleting and Special Stock

When Purchasing Depleting and/or Special Stock, the Purchase Values will be entered into your Stock On Hand Asset Accounts for each Stock Record, using the Stock GL Groups setup and added to each Stock Record. These Stock GL Groups will have a Purchase (Asset) Account, a Cost of Goods Sold (COGS) Account, and an Income Account for each Group.

Non Depleting Stock

As Non Depleting Stock is classed as a Stock for which you do not want to track Quantities or Values, when this stock is purchased the value goes straight into the Cost Of Goods Sold account, selected in the Stock GL Group for that Stock, not a Purchase Asset Account. This method of dealing with Non Depleting stock allows us to keep an accurate Stock On Hand value within the General Ledger and Jim2.

|

The use of non depleting stock within a business should be kept to a minimum as it does not keep an on hand quantity or value. |

Expenses Applied to Purchase Orders

If an Expense PO is applied to a purchase order, it will disregard the General Ledger account selected (you must select a GL account, as this is a mandatory field) and use the Expenses on Purchases account, and from there be distributed to the correct Stock on Hand Stock GL Group accounts.

Once a PO or Expense (whichever is last) is finished, the Expense amount goes into the Expenses On Unfinished POs account – then we split the Expense into Depleting, Special, and Non Depleting.

Depleting and Special expense amounts go into the related Asset Purchase Account/s.

Expense POs have no impact on journal stock, and the journal stock amounts will be ignored for the purposes of distributing COGS.

Non depleting expense amounts will be transferred to the Non Depleting Cost of Goods Sold (COGS) account/s.

Once sold, the Depleting and Special COGS are transferred to the related COGS account for that stock. This is the COGS (Price + Exp).

Manufacturing COGS

Once a job is manufactured, it creates a PO on the status of Finish, which moves the raw material dollar values into the related Stock On Hand account for that manufactured stock. We can display the COGS with Applies and Labour in the PO to use for pricing, but use Price (raw materials – depleting and special stock only) for COGS.

Once the product is sold we transfer from Stock On Hand, the Price or Price + Expenses into the related COGS account.

Average COG (PO)

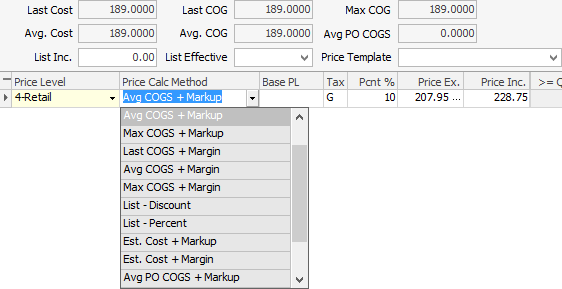

This stock pricing calculation method allows you to set the selling price to be Average COG (PO)+ Markup or Average COG (PO) + Margin.

The Average COG (PO) changes only at point of purchase – not at point of selling as per the normal Avg COGS + Markup or Avg COGS + Margin methods.

To understand how this works follow the example below:

Action |

Qty in Stock |

Actual PO COGS |

Average PO COGS |

Purchase 10 units |

10 |

$10.00 |

$10.00 |

Sell 5 units |

5 |

$10.00 |

|

Purchase 10 units |

15 |

$20.00 |

$15.00 |

Sell 10 Units |

5 |

$15.00 |

|

This pricing method is only for the calculation of actual selling prices. The COGS posted to the General Ledger at point of selling is the correct FIF0 (actual) cost of goods. |

Further information: