This section of the Purchase/Expense Order form contains buttons, tabs and information relating to the dollar totals of the purchase/expense order.

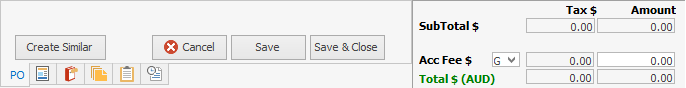

Jim2 Expense Order Footer

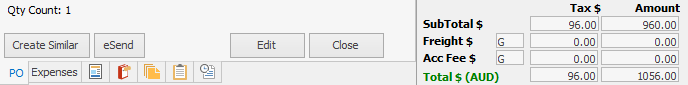

Jim2 Purchase Order Footer

|

The fields are different between expense orders and purchase orders. Purchase orders has an extra Freight field.

The eSend button will appear for Vendors if you are using Jim2 eBusiness. |

The fields on the right-hand side of the (purchase order) footer are described below. You will note that there are two columns within this area, the left column displays the tax component of the related field on the right:

Column |

Field |

Explanation |

|---|---|---|

Tax $ |

Sub Total $ |

Tax component of the stock in the left column. |

Freight $ |

Tax component of the freight (PO only). You are able to adjust the dollar value of the tax component of the freight by right clicking and selecting to either increase or decrease by one cent at a time. |

|

Acc Fee $ |

Tax component of the account fee value. |

|

Total $ |

Total tax component of the purchase order. |

|

Amount |

Sub Total $ |

Shows the stock total minus the tax component. |

Freight $ |

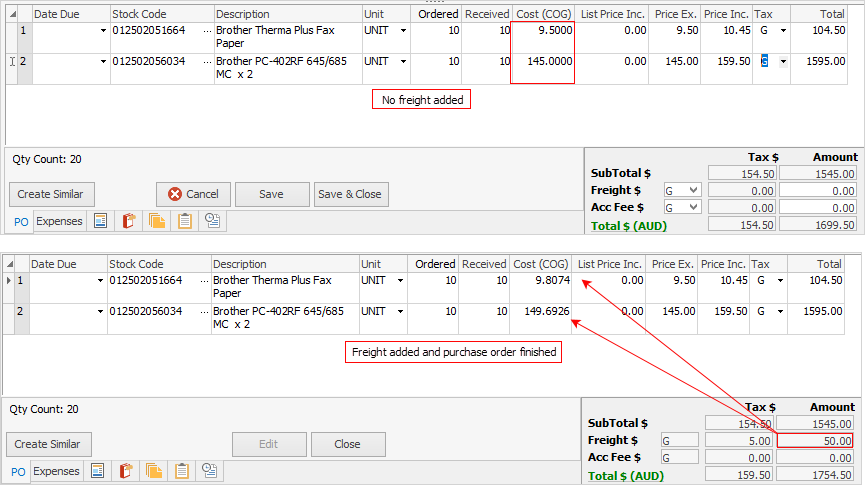

This field is editable to enter a figure for freight on the purchase order. This field is editable to allow entry of a figure for freight on the purchase order. If you enter an amount here, upon finishing the order the COGS of each stock line will increase based on what you have selected in the Freight to Cost By field in the Purchase Order header – value, weight or quantity.

|

|

Acc Fee $ |

This field is intended to be used when a vendor offers you a discount if paid on time or early. If terms are met, this amount will show in the Account Fee Discount column in the Creditor form and will be posted to the correct GL expense account – Purchase (Account Fee). If terms are not met, this amount will form part of the overall total and will not appear in the Account Fee Discount column.

If your vendor always charges a standard account fee this is better handled by creating a stock code and pointing it to where you would like to expense it in the general ledger. |

|

Total $ |

Total of the purchase order. |

|

As freight and account fees are subject to GST, the field next to Freight $ and Account Fee $ is the tax type defaulted from the Tax on Freight and Account Fee fields in the Purchase Options tab, accessed via Tools > Options > Purchase. There are additional tabs and buttons in the purchase order footer that are explained in detail in the Purchase/Expense Tabs and buttons section. |

Further information: