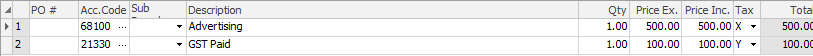

This section of the Expense Order form contains a grid used to record any expenses that have been incurred in relation to a purchase order.

Within this grid is displayed information regarding the cost of the goods, the tax free and the tax paid price of the goods, the tax code and total of the expense.

Expense Order expanded view

The fields within the expense grid are described below. Depending on your Options/Setups, it's possible that not all of these will be available.

Field |

Explanation |

|---|---|

Date |

The date the entry is made. |

Initials |

The initials of the user who made the entry. |

PO# |

The purchase order number that the expense relates to. |

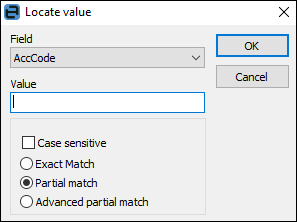

Account Code |

General ledger code for this expense.

Note: Ctrl+S will open the Locate value screen to assist in locating the required code. |

Branch |

Enter the branch (only visible if you use Branches). |

SubBranch |

Enter the sub-branch (only visible if you use SubBranches). |

GL Dept |

Select a GL department (if required). |

Description |

This is a description of the expense. |

Qty |

Number of the units incurred. |

Price Ex |

The price of the expense without tax. |

Price Inc |

The price of the expense including the tax component. |

Tax |

Tax code. |

Total |

Total amount of the expense. |

|

If you are entering a negative expense order, the quantity is still entered as a positive number, as we do not keep track of quantities for expenses. Only the dollar values should be entered as negative values. |

|

If the expense is applied to a purchase order, it will disregard the general ledger account selected and use the Expenses on Unfinished POs account, and from there will be distributed to the correct Stock on Hand – Stock GL Group accounts. You cannot select a branch, sub-branch or GL department if the expense is applied to a purchase order. |

Further information: