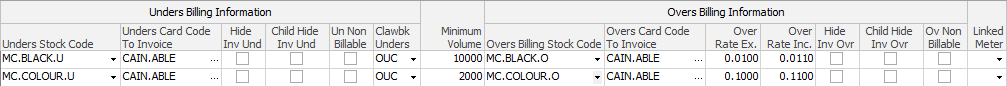

A master has two colour machines with a minimum volume for both black and colour. Open unders are clawed back at the current rate (OUC). There is a minimum of 10,000 pages for black and 2,000 pages for colour.

The first month's reads are exactly the same as this example. The master job is created without leaving unders open. The jobs created are exactly the same.

In the following month the first machine receives reads of 36,000 (7,000 pages) black and 12,300 (800 pages) colour, and the second machine receives reads of 58,000 (5,000 pages) black and 9,400 (400 pages) colour.

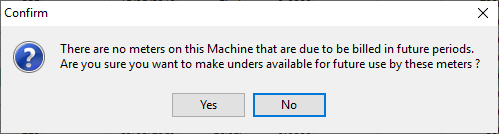

The master job this time is created by clicking Generate Job Unders Open. The following warning is displayed. The reason this warning is displayed is because you are opting to leave unders open, however every meter is being billed this period, and Jim2 expects by default that you will close off the period, and not leave unders open. Click Yes to override.

|

No unders or overs are clawed back. Because the first month was not billed with Leave Unders Open, they are effectively closed off to the second period. Therefore, the jobs that are created are exactly the same as the second period in the previous example. |

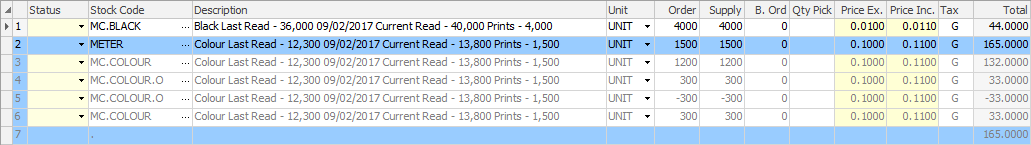

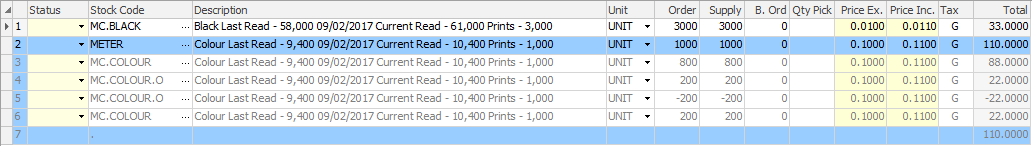

The third month reads of 40,000 (4,000 pages) black and 13,800 (1,500 pages) colour for the first machine, and reads of 61,000 (3,000 pages) black and 10,400 (1,000 pages) colour for the second machine.

The master was billed with Leave Unders Open, although this only affects the calculation for future months, not the current month.

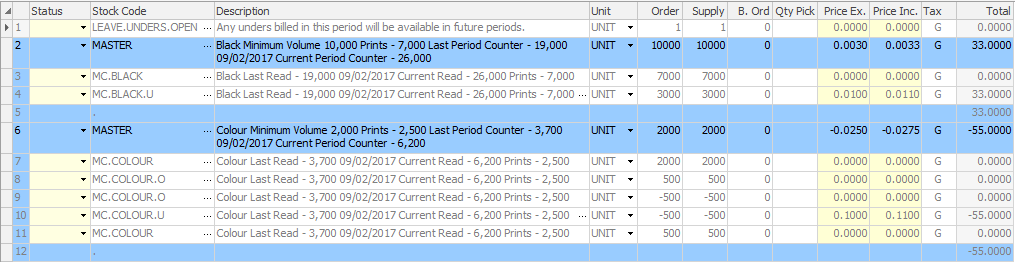

Once jobs have been created for the two children and the master, they will appear as follows:

Machine 1

Machine 2

Master

We can see that the black overs in the second period are not clawed back in the third period because this contract is only set up to clawback unders (not overs).

The colour unders charged in the second period are however clawed back in this third period. With colour, all 500 unders charged in month 3 are clawed back because there were 800 unders charged in month 3.

The invoice for this master as a whole would be (10,000 X 0.01 + 2,500 X 0.1 = 350.00) less the unders clawed back from month 2 (– 500 X 0.1 = 50.00).

This would produce an invoice for $300.00 ex tax.

Further information: