|

To commence adding purchase orders into Jim2, Option defaults must first be set up and information entered into user and vendor cardfiles. |

1.Click Add Purchase on the ribbon.

![]()

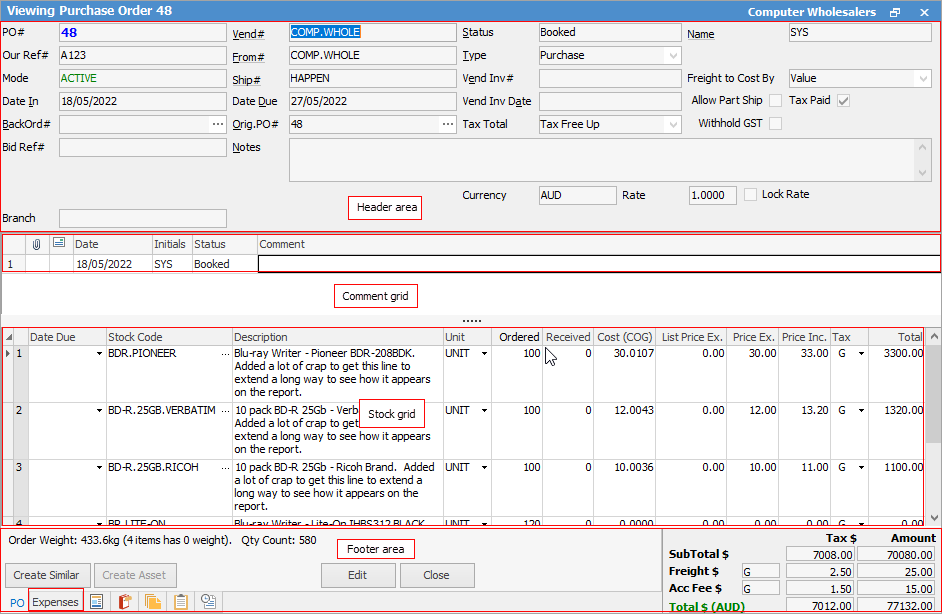

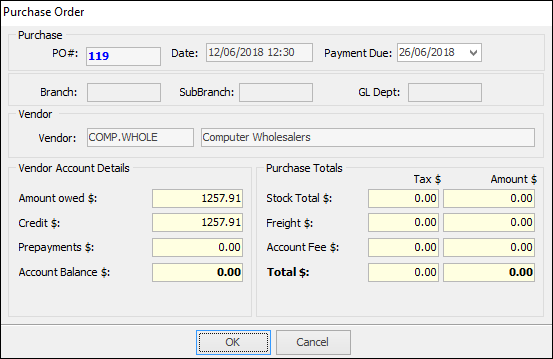

2.The Adding Purchase Order form is displayed. Jim2 automatically fills some fields in the purchase order header, including the PO#, Status, default Ship# (if set in Tools > Options > Purchases), Type, Date In, Orig. PO#, Tax Total, Freight to Cost and Account Fee Tax Codes.

|

Some letters in the field names within the header are underlined, eg. Vend#. Using Alt+ the underlined letter will jump to the field beside that heading. |

Jim2 is designed to prompt user input by placing the cursor at the appropriate fields that the user is required to complete. The Enter key will move the cursor to the next user input field in the purchase order entry pattern. The pattern follows:

▪Vendor Card Code#

▪Vendor Invoice Date

▪Vendor Invoice#

▪Notes – Shipping or payment notes

|

Some of this default information can be overridden by using the Tab key or mouse to move to that field, highlight and re-edit. The exception is that the PO# and Date In cannot be edited as they form part of the secure Quality record for each Purchase. |

2.Select a vendor in one of the following ways:

▪Start to enter the vendor code. Jim2 intuitive type will begin to (numerically/alphabetically) pre-empt the choice of names from the card code list information is entered.

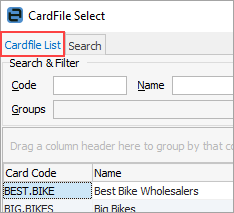

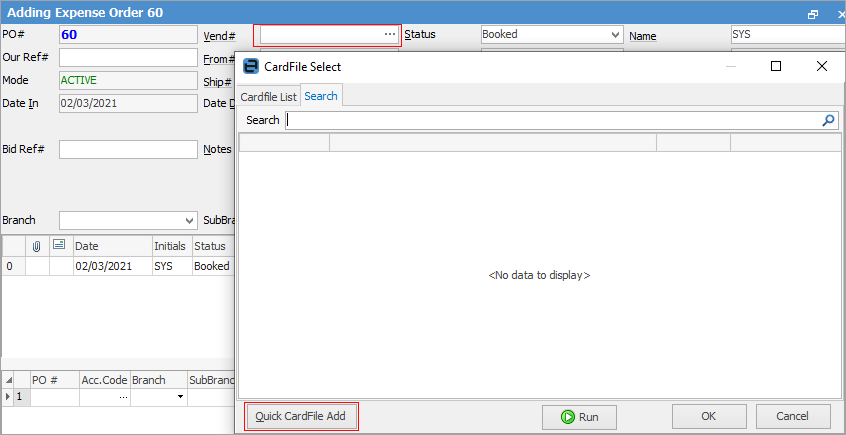

▪Click the ellipsis [...] beside the Vend# field to display the search screen.

▪A full list of vendors can be accessed via the CardFile List tab, then choosing from the list.

If there is no cardfile for the vendor, when in the Cust# field use F5 select Quick CardFile Add to enter a new cardfile. This can then be used on the current expense order.

|

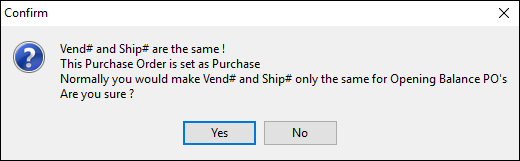

If the Vendor# and Ship# are the same on a purchase order, when finishing the order a confirm message will appear if the purchase order is not an opening balance purchase order. It would be highly unusual for a purchase order that is not an opening balance purchase order to have the same Vendor# and Ship#. |

|

Jim2 uses information and calculations from the vendor cardfile records to automatically add default information into certain fields of the purchase order. To change any of these default values, move to the field to change and use the drop down list in that field, or highlight and change the entries. |

3.Select a date the vendor has promised the goods are to be delivered by as the date due, or use the required days information calculated using information from the vendor's cardfile.

4.Enter a specific message in the Notes field in the Purchase Order header – any special delivery or payment messages (this message will appear only on this purchase order).

5.Add comments and stock to this purchase. The F3 function key will move to the Comment grid and the F4 function key will move to the stock grid.

|

The Job# column will populate if this purchase order has been auto created from a job. Nothing can be entered here otherwise.

The Location column (in expanded view) will populate with a location, however this can be edited. |

6.Freight can be added to the purchase order on the bottom right of the purchase order form. If freight is added in this way, it will be distributed evenly over each of the stock lines.

7.Once the stock has been received and ticked off against the purchase order, update any prices and change the status of the purchase order to Received. This will update the stock records, allow the stock to be sold to customers and an estimated value (the total value including GST on the purchase order) entered into the general ledger accounts 1-XXXX Stock on Hand – Purchase Orders on Received and 2-XXXX Temporary Creditors – Purchase Orders on Received.

8.Once the invoice is received from the vendor, check the prices and edit if necessary, add any freight charges to the freight field in the purchase order footer, check that the purchase order total agrees with the vendor invoice total, change the status to Finish, and save the purchase order.

|

Note: If you receive more than one invoice from the vendor for the same purchase order, these can all be entered in the Vend Inv# field. |

Once the status is changed Finish and Save is selected, a message will appear to again confirm that the total figures in this purchase order match the invoice that has been sent from the vendor.

The Payment Due date can be changed here, if required.

The temporary entry will then be reversed and the real values will be posted to the exact general ledger accounts.

|

There are no financial transactions on purchase orders on statuses other than Received or Finish. |

8.Sometimes there is a small difference between the total of the purchase order entered into Jim2 and the total of the vendor's invoice. This can be due to the vendor's software using a different method of calculating GST (eg. calculated at line level or on the invoice total) or due to rounding. Jim2 calculates GST at stock line level. The purchase order total can be adjusted to match the Vendor invoice using two different method

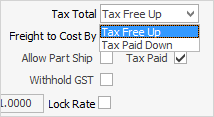

The first method to try is to change the Tax Total method on the purchase order. For example if the default method is Tax Free Up try changing to Tax Paid Down.

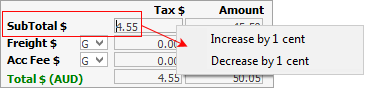

If there is still a small difference after changing the Tax Total method, use the Increase (GST) by 1cent or Decrease (GST) by 1cent function. Right mouse click in the Tax SubTotal field in the footer of the purchase order (or expense order) and choose to either Increase by 1 cent or Decrease by 1 cent. Repeat this as many times as required to balance the purchase order total to the Vendor invoice total.

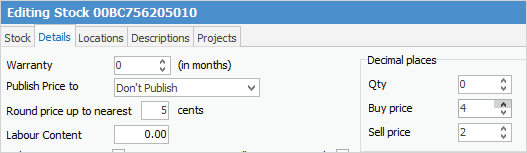

Using either of these methods often resolves any variance, however there are instances where there is still a discrepancy. As the purchase order amounts are driven by the stock record, change the stock record to use 4 decimal places which may alleviate this:

|

If a purchase order has been cancelled accidentally, edit it and change the status to what is required.

A purchase order can also be created from an email, and the email will be linked to the purchase order. |

Further information

Purchase/Expense Order Footer Tabs

Purchase Order Approval Process

Opening Balance Purchase Order

Add an Amount to a PO when Finished at $0

Add Comments to a Purchase/Expense Order

Add Freight to a Purchase Order

Fix Incorrect Pricing after PO Finished

Handle Employee Reimbursements

Handle a Credit for Freight Charged

Link a Job to a Purchase Order

Link Expenses to a Purchase Order

Print a Purchase/Expense Order

Progress Payments on Purchase Orders

Record One Invoice Number on Multiple POs

Record Overseas Purchases, GST, Import Costs